Using only consumer purchase intent data to predict new product success is fundamentally flawed

New product concept research focused on consumer purchase intent is not an accurate enough way to predict new product success for 4 fundamental reasons. Despite this, it is used most often by FMCG marketers to predict new product success. As background, consumer purchase intention is measured through a survey where respondents are provided with a description, image and price point for the new product and asked how likely they are to purchase the product, on a 5 point scale: 5=“definitely will buy,” 4=“probably will buy,” 3=“may or may not buy,” 2=“probably will not buy,” and 1= “definitely will not buy.”

There have been many papers and a lot of opinions shared about how good purchase intention is at predicting behavior in-market. The reason for all this discussion traces to the fact there is a very fuzzy relationship between “behavior intention” and “actual behavior” at best. To try and figure out the correlation between the two, normative data has often been used. However, the bottom line is that this type of new product concept testing has failed miserably in helping marketers pick winning new product concepts. As AC Neilson says, “It’s a sobering fact that more than 85 percent of new fast-moving consumer good (FMCG) products fail in the marketplace.”

So why do many FMCG marketers still focus on this flawed predictor of new product success?

- It is a lot more time and cost effective than test markets/mock in-store tests

- Up until more recently, there were no real viable alternatives

- Long history as “the way” to test new products

Purchase intent is a poor proxy for purchase behaviour

Asking about purchase intention through a survey is far different than having them shop as they normally would and measuring what they see and do. Asking them through a survey without the context of shopping in-store has respondents use a System 2 mode of thinking (effortful, slow and controlled way of thinking) whereas when they are shopping, they are more likely to be in a System 1 mode of thinking (an automatic, fast and often unconscious way of thinking – autonomous and efficient, requiring little energy or attention, but is prone to biases and systematic errors).

Through V-SHOPPER, we regularly measure significant differences between consumer purchase intent and actual purchase behaviour.

Consumer purchase intent research cannot measure trial rate without brand awareness

It’s all well and good to get a measure of purchase intent with 100% brand awareness (by showing them the new product concept) but that is not realistic scenario in-market. Reality is that most shoppers will not be aware of a new product before they shop. Given this scenario, how many of these shoppers will actually notice the new product on-shelf and subsequently buy it? This is a massive blind spot for FMCG marketers in terms of assessing new product viability.

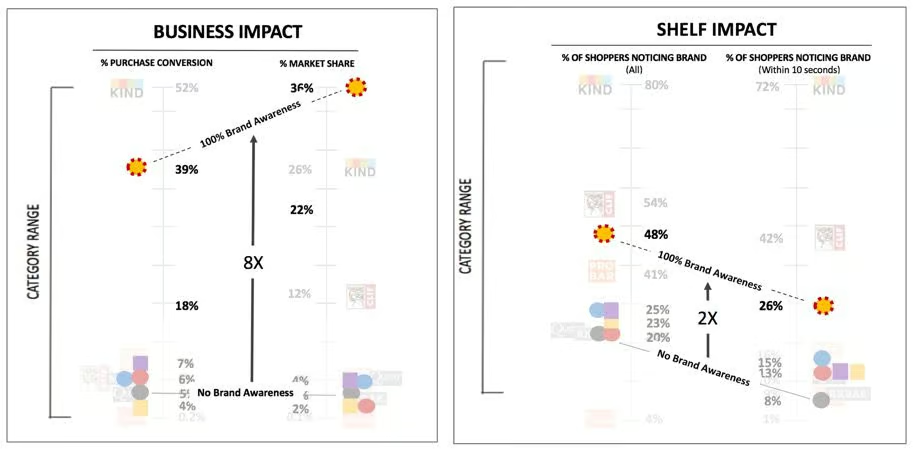

Using V-SHOPPER, we have measured the impact of brand awareness on shopper attention and paid conversion. The gap in behaviour between 0% and 100% brand awareness varies based on the strength of the product concept and the category, but typically the difference is significant.

Consumer purchase intent research does not factor in brand shelf impact and its effect on sales

Brand presence in-store, particularly for new products, is essential to generating consumer trial. From V-SHOPPER studies completed to-date, the category range in terms of the percentage of shoppers noticing a brand on-shelf typically ranges from 25% to 85%. In other words, the new product’s packaging and shelf placement have a material impact on new product sales.

Consumer purchase intent research does not take into account brand findability and its impact on trial rate

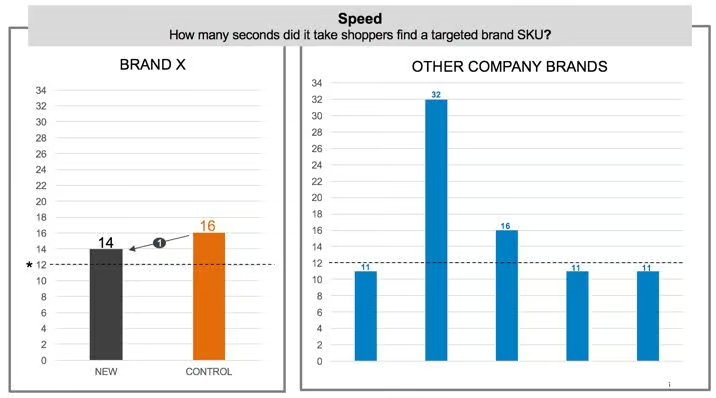

80% of purchase decisions are made within the first 10 seconds of shopping the section in-store. So, for those that are aware of a new product and are looking for it in-store, if they can’t find it in 10 seconds or less, there is clear evidence from previous studies run, that sales will be lost. Through V-SHOPPER, brand owners are often surprised at how long it takes for shoppers to find a brand SKU (50% of findability test results have shown that it takes 16 seconds or more for a shopper to find a targeted brand SKU).

V-SHOPPER uses real store shelves in a virtual shopping environment to confidently predict new product business impact by measuring actual shopper behaviour at the moment-of-truth. With a .85 correlation between test results and real-world shopping results, V-SHOPPER produces highly predictable results.