Research

Design

V-Shopper

Attention-tracking technology has revolutionized the field of packaging design.

Grow Your Brand With Confidence Using Virtual Store Research

In this video, we delve into the advantages that marketers can gain when they opt to collaborate with design agencies employing shopper analytics to shape and enhance their packaging designs.

Here at Marovino, we harness the power of our V-Shopper technology to aid brand owners in seamlessly incorporating critical design metrics such as Visibility, Engagement, and Purchase Conversion into their design processes.

This strategic approach empowers them to fine-tune their packaging designs and set well-defined, quantifiable performance standards before the product’s launch. By doing so, we eliminate the uncertainty associated with selecting a design for market release and instead rely on valuable consumer feedback to inform our decision-making process.

our thinking

…on design analytics

V-Shopper: Shopper Attention Tracking assists Package Design Strategy

A study published in the Journal of Food Products Marketing (21 May 2016), recognizes Visual Diagnostics’ Attention-Tracking methodology as “an emerging technique to improve the study of in-store shopper behavior and decision making.”

Read it V-Shopper: Shopper Attention Tracking assists Package Design Strategy

Purchase Intent vs. Purchase Conversion

Using only consumer purchase intent data to predict new product success is fundamentally flawed. New product concept research focused on consumer purchase intent is not an accurate enough way to predict new product success for 4 fundamental reasons.

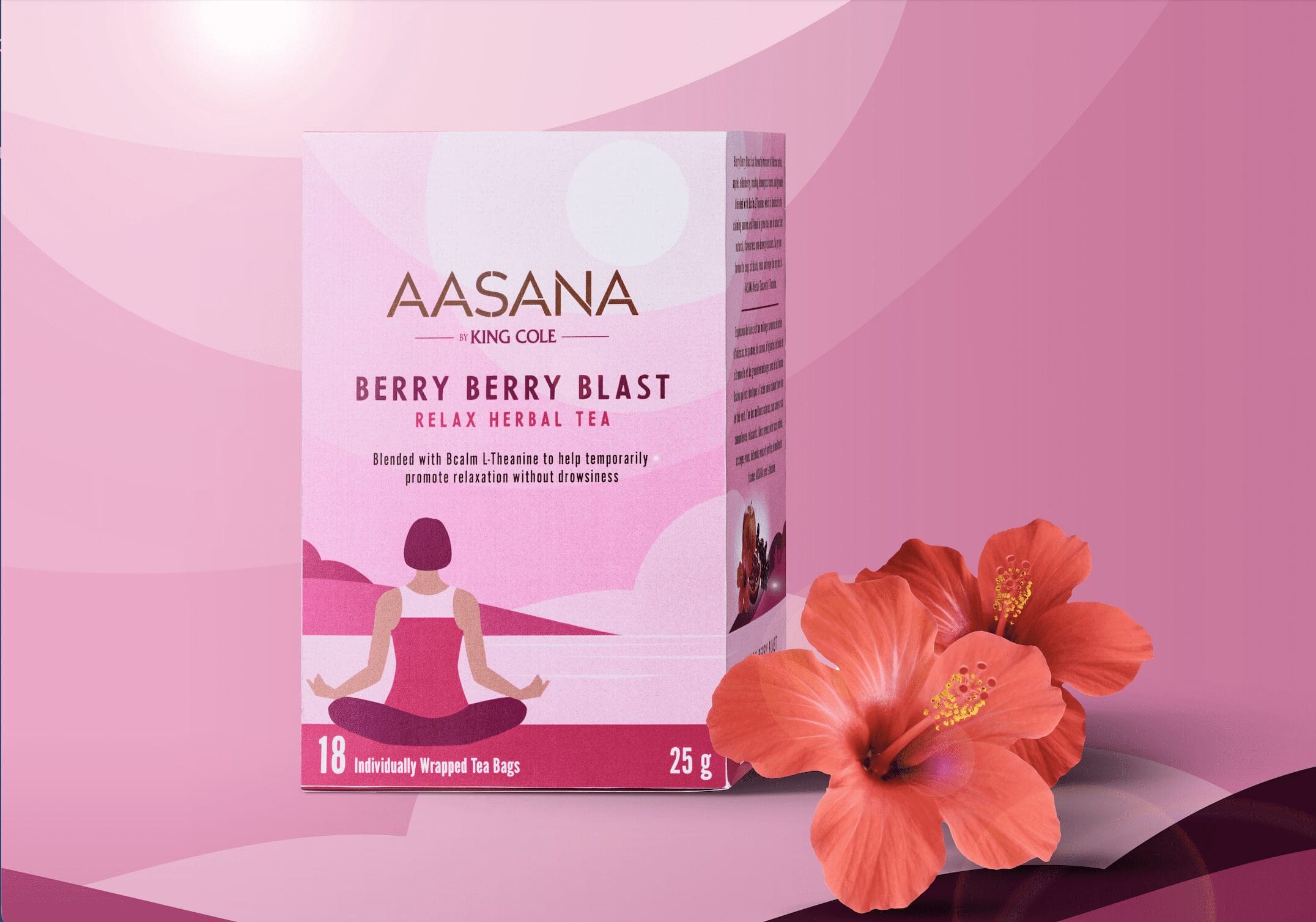

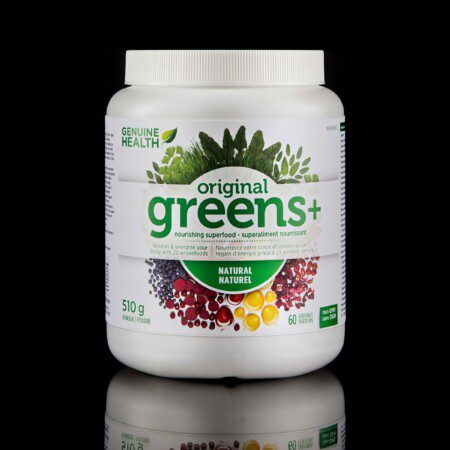

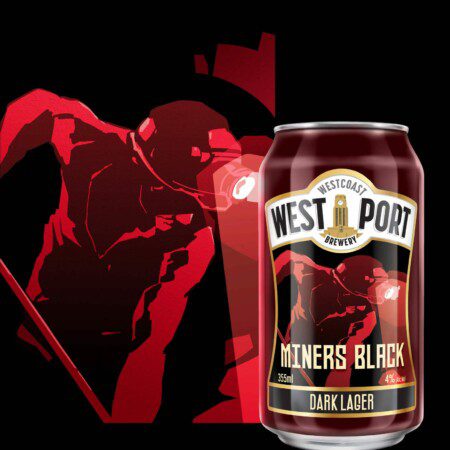

Design Portfolio

performance-driven pack design

Leslie Stowe

More Family Brands

Holiday Snacks

Dare Bear Paws

Club House Spices

Genuine health brands

Clorox Dishwashing Detergent

Barista coffee liqueur

Iceberg vodka

King’s crown grooming products

Maple Lodge Farms

Club house wet rubs

Club house dry rubs

Nood snacks

Dare breton crackers

Club house organic spices

Westport miners black

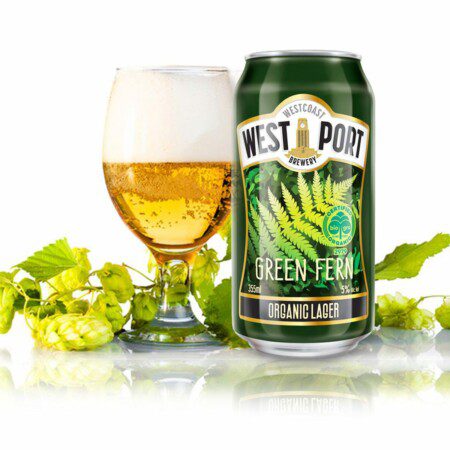

Westport green fern

our thinking

…on design strategy

Visual Brand Equity & Package Design Pitfalls

According to research from Perception Research Services, “It is far easier to damage a brand than to grow it via packaging design. In fact it’s about twice as likely, as approximately 20% of new packaging systems drove declines in purchases from the shelf – as opposed to the 10% that drove sale increases.”