HOW DO YOU MEASURE SUCCESS

In the CPG world, if we think of the saying “Out of sight, out of mind,” it leads us to ask: “Am I getting noticed?” Nowadays, the competition among brands trying to grab consumers’ attention has become more intense than ever with an ever-increasing number of new entries in every category

Advertisers use Reach as a key metric to assess their campaigns’ potential impact and gauge how well they connect with their intended audience. It helps in optimizing advertising strategies, budget allocation, and overall campaign effectiveness.

Despite the huge amounts of money spent on promoting products, advertisers are still left wondering whether their brands are indeed capturing the attention of consumers ‘at shelf’, and if their intended messages are getting through. This paper delves into a few design solutions to this challenge, based on empirical data from V-Shopper.

Low Shopper Engagement

Most marketers and consumer-insight experts share a common perspective on how consumer behaviour and brand loyalty affect purchase decisions when consumers are shopping for Fast-Moving Consumer Packaged Goods (FMCPG)

- Limited Brand Repertoire: Many consumers tend to have a small set of brands that they trust or consider acceptable within specific product or service categories. This limited repertoire implies that people often stick to what they know and are familiar with.

- Low Involvement Purchase Decisions: for most fast-moving CPG categories, consumers don’t invest much time or effort in making purchase decisions. They may not extensively research or compare different brands and products because of their busy lives, time restraints and other more important priorities.

- Habitual Buying: Habitual buying behaviour is highlighted as a common mode of consumer decision-making. This means that consumers often buy the same brand repeatedly because it has become a habit or a routine choice.

- Instinctual Decisions: The term “instinct” is used to describe another way consumers make purchase decisions. This implies that consumers may rely on their intuition or gut feeling when selecting products or services, rather than a deliberate analysis of options.

- Low engagement: The idea that consumers “engage” with brands applies primarily to a limited group of consumers and certain high- involvement product categories and brands. When it comes to consumers’ interaction with products in a standard grocery store setting, shopping is typically a process that consumers want to be over with as soon as possible. It usually involves a brief information-gathering process aimed at answering common questions such as: “Is this the product I need?” ”Is it better than other options?” and “Should I give it a try?”

3 Key Elements

Our Attention Tracking studies reveal that shoppers can lock in on two or three visual elements from a package in just a fraction of a second, helping them decide if the product is worth their consideration.

Identifying the top three key elements that instantly capture the attention of shoppers is a vital step in enhancing your brand’s performance during the First Moment of Truth.

Typically, these elements can be the dominant color, an image, and/or the brand name. It’s worth noting that our brains process images much faster than text; seeing is instinctive, while reading is a skill acquired over time.

From a designer’s perspective, this implies that our designs should prioritize information in the order shoppers naturally prefer to process it. In the marketing realm, this sequence of processing information is referred to as the “Decision Tree.”

Reason to Believe

To seal the deal, your package design needs to have a “closer” – a compelling reason for shoppers to believe in your product. When they wonder, “Why should I give this a try?” the answer should be brief, persuasive, and aligned with your brand’s positioning statement.

Brand owners often feel tempted to overload their packaging with excessive information, flashes, banners, and more. But, as the saying goes, “more is more, but less is better.” Achieving simplicity can be challenging but is highly effective in driving engagement.

Keep in mind that each additional element you add to the front of your package competes for attention with your three most important visual elements. There’s an inherent trade-off for every extra element on the package’s front panel: there is a distinct tipping point where consumers stop reading and simply move on to the next item.

Visibility

To connect with consumers effectively, you must first catch their attention. Visibility is the most important factor influencing their decision to make a purchase. Visibility leads to engagement which leads to purchase. As the saying goes: Not seen – not bought.

The strategies for achieving Visibility differ depending on whether your brand holds a dominant market position with multiple product facings at eye level or if you’re a challenger brand with limited facings and less favorable shelf placement. For a more in-depth explanation of these tactics, you can refer to our e-book.

We’ve successfully improved shelf performance for numerous challenger brands by increasing Visibility. Visibility boosts the pool of potential buyers who will consider making a purchase. Ultimately, this heightened attention leads to a greater conversion rate for your brand.

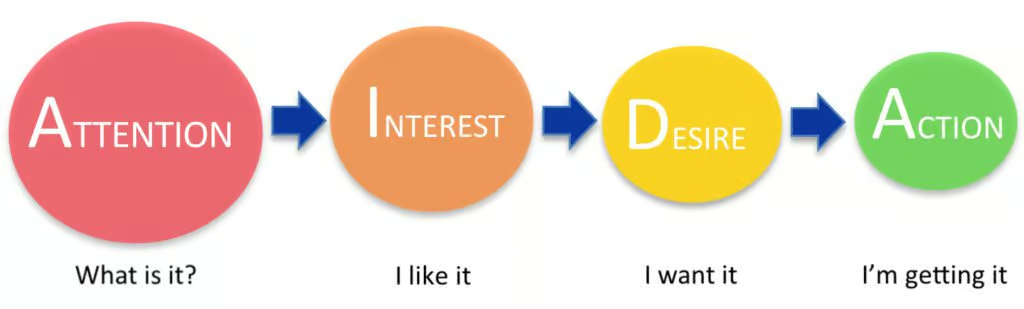

The AIDA model is the foundation for our design approach. This framework assists us in prioritizing the elements on the face panel in the optimal communication hierarchy. Our goal is to capture the attention of shoppers, provide them with relevant information to encourage them to make a purchase and subsequently to build memory structures that will aid in future purchases.